The Rising Burden of U.S. Healthcare Costs

High spending, uneven outcomes: the urgent case for reform.

October 17, 2025Lurking behind the U.S. healthcare system is an unsettling truth: Americans pay more for healthcare than every other developed nation, yet our health outcomes often fall short in comparison. U.S. healthcare spending is not only high, it's heading even higher, projected to grow faster than the economy for the next decade. With healthcare already accounting for one fifth of Gross Domestic Product (GDP), policymakers, healthcare leaders, and payers alike must fundamentally rethink strategies for affordability and long-term sustainability.

The Relentless Rise of National Health Expenditures

A recent analysis by CMS actuaries, led by Sean Keehan, paints a stark picture of future spending. National Health Expenditures (NHE) rose by an estimated 8.2% in 2024 and are anticipated to climb another 7.1% in 2025. While the pace is expected to ease slightly thereafter, spending is still projected to rise 5.6% annually in 2026-27, then average 5.8% yearly – consistently outpacing the estimated GDP growth of 4.3% per year.

This persistent imbalance means healthcare’s slice of the U.S. economy will expand significantly, rising from 17.6% of GDP in 2023 to a projected 20.3% by 2033 - approximately one-fifth of the nation’s total economic output.

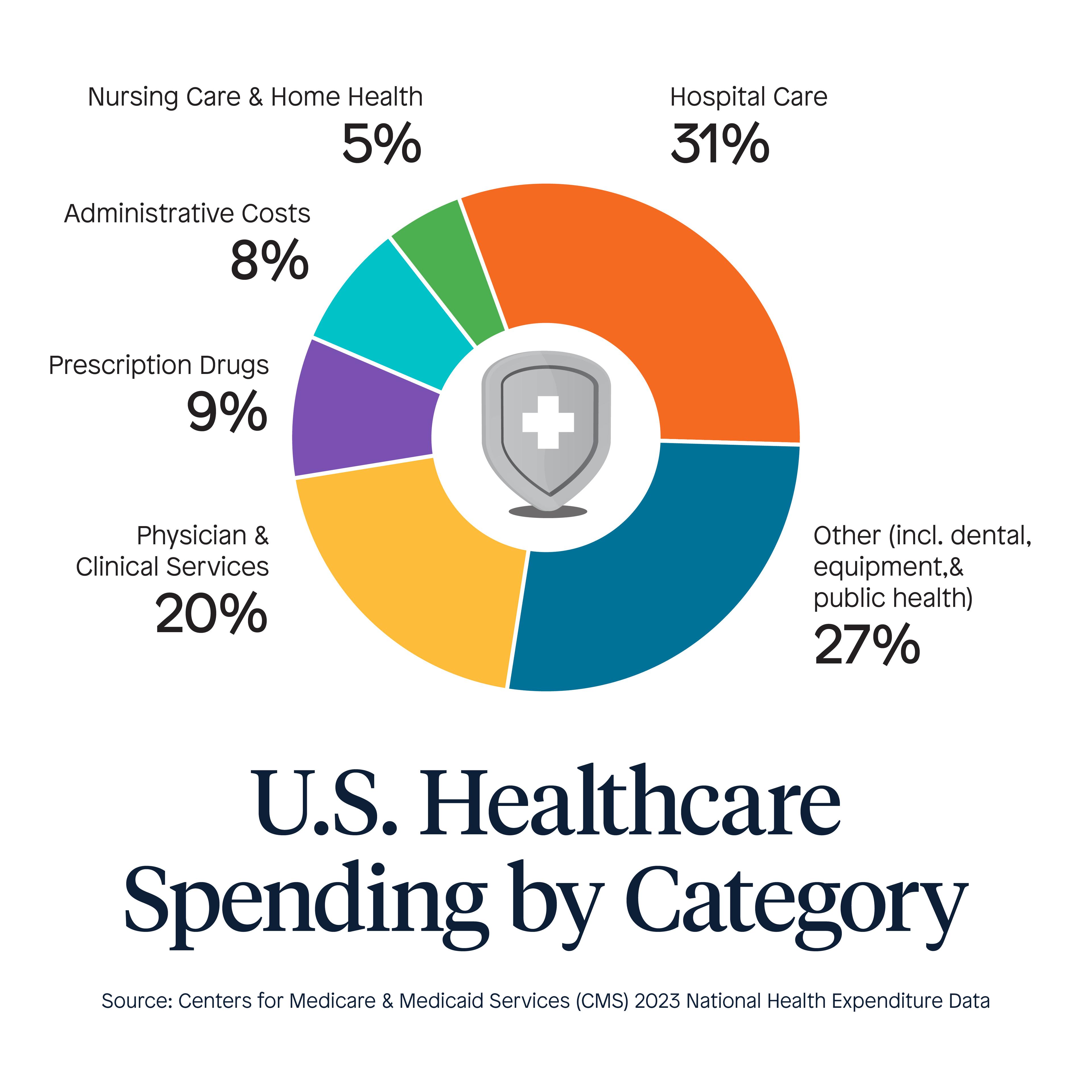

Where Does All the Money Go? A Breakdown of U.S. Healthcare Spending

Understanding the composition of this massive expenditure is crucial. According to the Centers for Medicare & Medicaid Services (CMS) 2023 National Health Expenditure Data, spending is categorized as follows:

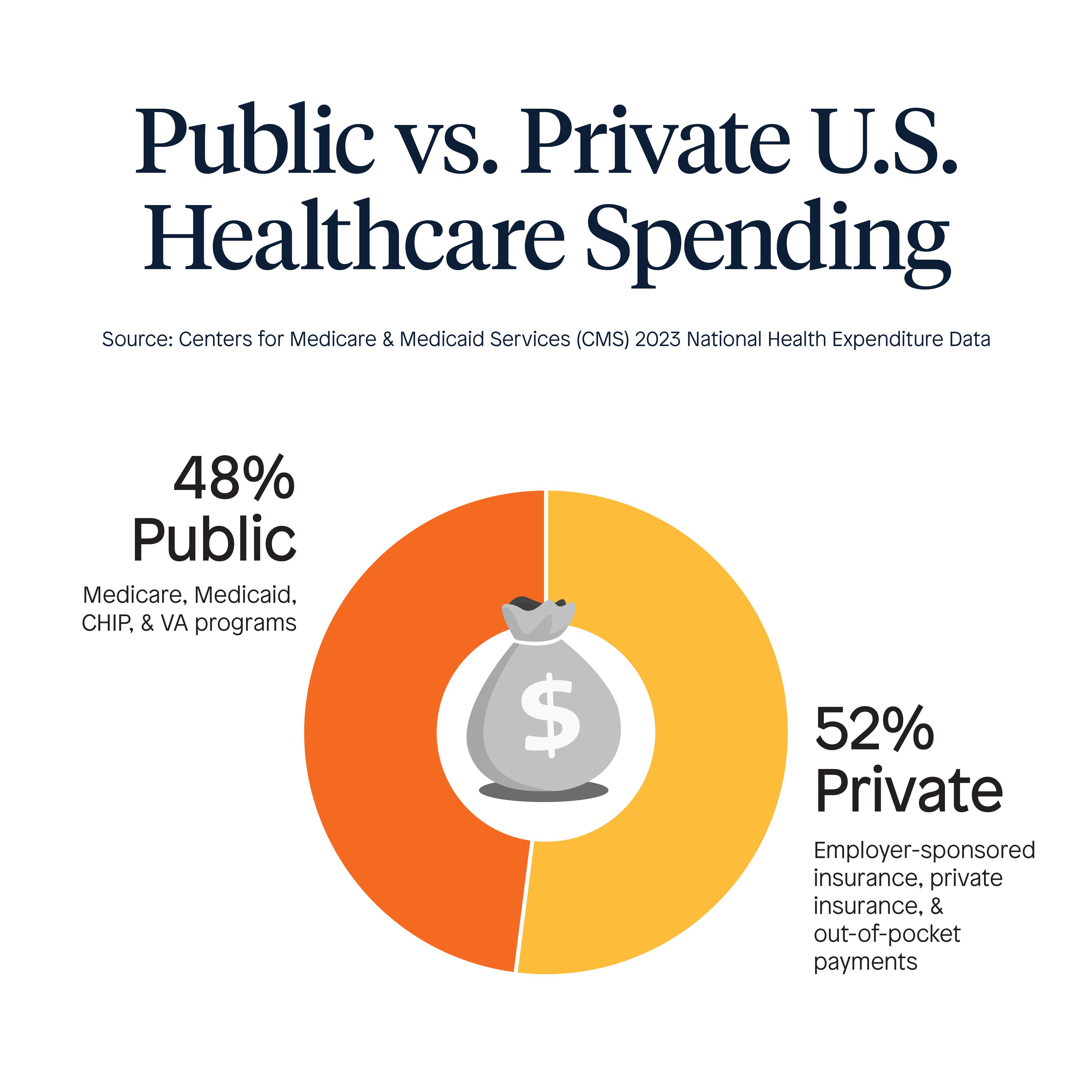

Spending is nearly equally split between public and private sources:

Healthcare costs also vary dramatically by demographic factors. According to CMS estimates of National Per Capita Personal Health Care Expenditures, spending increases substantially with age:

This trend underscores the financial impact of aging populations on national health expenditures and the importance of designing cost-effective, age-responsive care strategies.

The Heavy Burden on American Families

Healthcare isn't just a macroeconomic issue; it's one of the most significant household expenses for American families.

In 2024, the average annual premium for employer-sponsored family health insurance exceeded $25,000, with employees contributing about $6,296 on average.

Out-of-pocket costs have also surged, leaving many families vulnerable to copays uncovered services, often leading to skipped or delayed care due to financial concerns.

According to a recent West Health-Gallup poll:

58% of Americans are concerned that a major health event could lead to personal medical debt.

12% of U.S. adults -- or about 31 million Americans -- report they had to borrow an estimated total of $74 billion in the past 12 months to pay for healthcare for themselves or a household member.

Reining in these runaway costs requires decisive, multi-faceted action across the healthcare ecosystem including better transparency of costs, reduced administrative burden, and reform of how we pay for healthcare services and drugs. The challenge is immense, but the imperative is clear. Addressing the upward trajectory of U.S. healthcare spending requires a commitment to innovation, transparency, and a fundamental re-evaluation of how we deliver and pay for care.