Housing Cost Burden Among Older Adult Renters

July 11, 2025Increasing housing costs impact many people in the United States. As incomes decline with age and housing costs continue to rise,1 a growing number of older adults are at risk of financial hardship, housing instability, and even homelessness. According to the U.S. Census Bureau, housing costs rose between 2022 and 2023 for renters and homeowners.2 In a 2025 report from the Congressional Research Service (CRS), nearly 50 percent of renters and 24 percent of homeowners were housing cost burdened in 2023, meaning they spent more than 30 percent of their income on rent, mortgage payments, and other housing costs.3

The CRS report also highlighted the following:

66.5% of renter households with incomes below $30,000 were severely housing cost burdened, spending more than 50 percent of their income on housing costs

Renter households headed by an older adult or person with a disability experienced higher rates of housing cost burden (over 55 percent) and accounted for a disproportionately high share of severely housing cost burdened renter households (a combined 33% of severely burdened renter households but only 25% of all renter households).

As the older adult population continues to grow, housing affordability issues are becoming more prevalent. In 2023, nearly 11.2 million older adults spent more than 30 percent of their income on housing costs, up from 9.7 million people in 2016.4 These rising numbers point to a growing crisis for older adults.

In 2023, 57 percent of older adults age 65+ who rent were housing cost burdened compared to 27 percent of older adults who were homeowners.

Why Older Adults Renters Are Disproportionately Impacted

While many older adults feel the pressure of rising housing costs, renters face a disproportionate burden. Several interrelated factors contribute to these disparities:

Fixed or declining incomes: As people age, they often retire, reduce work hours, or experience the loss of a spouse’s income. These shifts reduce household earnings and make it more challenging to keep up with rising rents. For example, due to these challenges as well as reduced savings, older California renters age 75+ face an increased likelihood of even greater cost burdened than older adults age 62+.5 Older female renters have an elevated risk of housing instability for reasons such as lower wages due to the gender wage gap and leaving the workforce to be a caregiver. Additionally, women tend to live longer than men, thus having a longer period of time to live on a fixed or reduced income.6

Lack of home equity: An estimated 7 million older adult households rent, although this number is expected to grow due to lower homeownership rates among those now in their 50s and 60s.7 Unlike homeowners, renters do not benefit from the stability or financial cushion of home equity. Many older homeowners have paid off their mortgages, while renters often experience the unpredictability of rent increases.8

Rising rents and limited affordable options: Rental prices continue to rise across the country, while the supply of age-friendly, affordable rental options lags far behind demand. Some government programs are available to provide housing assistance support but the demand often is greater than the supply, leading to lengthy waitlists in some areas.9

“Access to affordable housing for older adults and people with disabilities is limited and varies by state, contributing to greater housing cost burdens and risk of homelessness.”

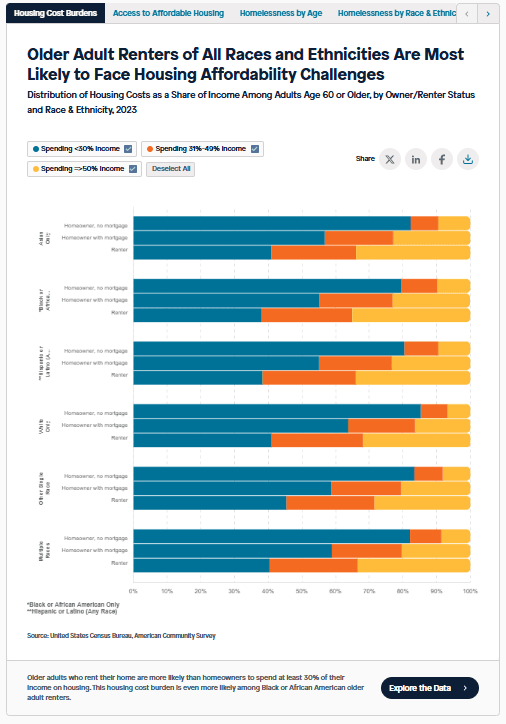

Racial and ethnic disparities: Based on the American Community Survey data, older adult renters of all races and ethnicities are most likely to face housing affordable affordability challenges. However, older adults of color are more likely to rent than their white counterparts and face greater affordability challenges. The Joint Center for Housing Studies found that of Black and Hispanic households, 37 and 34 percent, respectively, were older renters.10 According to ACS data, the homeownership gap between Black and white older adults exceeds 19 percentage points.11

The Broader Implications of Housing Cost Burden

High housing costs can affect nearly every aspect of an older adult’s well-being.

Ability to age in place or community: Stable, affordable housing supports aging in place. Without it, older adults may face social isolation or worsened health outcomes.

Essential tradeoffs: When a large share of income goes toward housing, older adults are forced to cut back on other necessities like food, medications, transportation, and preventive care.

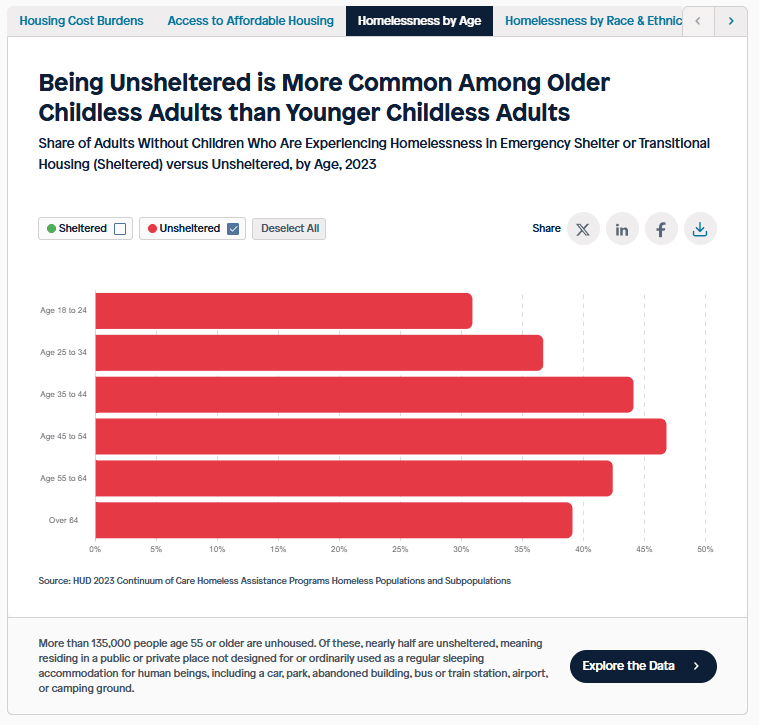

Homelessness and housing instability: Older adults aged 50+ are the fastest growing group experiencing homelessness for the first time12, with rising rent costs cited among the causes. A missed rent payment or unexpected expense can lead to eviction, which can have serious implications for a person with limited income or health issues.

Opportunities for Addressing the Housing Cost Burden for Older Adult Renters

Addressing this issue will require coordinated efforts at the local, state, and federal levels, alongside innovation in housing and aging services. Promising strategies include:

Expanding the affordable housing supply and innovative housing models by increasing investment in the construction and preservation of affordable, age-friendly rental housing or encouraging flexible, lower-cost models like shared housing, accessory dwelling units (ADUs), and co-housing. States have included strategies in their multisector plans on aging (MPA) to explore ways to expand affordable housing. For example, Pennsylvania’s plan includes a tactic focused on expanding a shared housing program to support additional populations.

Strengthening and expanding rental assistance programs, like Housing Choice Vouchers, with streamlined application and eligibility processes for older adults on fixed incomes. California’s MPA includes an initiative for 2025-2026, which focuses on promoting promising practices such as rental subsidies. North Carolina’s plan includes a strategy to increase participation in its Targeting Program, which focuses on low-income people with disabilities to help them remain in the community as they age. Participants in the program will also be able to participate in the Key Rental Assistance to help make the rent more affordable.

Supporting aging in place by investing in home modification and repair programs that help low-income homeowners remain in their homes safely. These programs can include accessibility upgrades and energy-efficiency improvements. States like Maryland and Pennsylvania have included strategies related to increasing access to programs like these within their MPA to ensure homes are safe and accessible for older adults.

Conclusion

As housing cost burden has major implications for the financial and health well-being of older adults, it is important for policymakers and other key stakeholders to address this issue. Through approaches like expanding the affordable housing supply or implementing strategies that help older adults age in place, there is an opportunity to make an impact on housing cost burden for older renters.